Brooks Brothers: What is the recovery plan by the new owners? Meanwhile, it appeals to reopen production sites, including that of Haverhill (Massachusetts), where 413 people worked. On the eve of August 15th, Delaware Bankruptcy Court approved the sale for 325 million dollars of Brooks Brothers to Sparc Group, the joint venture formed by Authentic Brands Group and Simon Property Group (the largest mall manager in the US).

The crisis

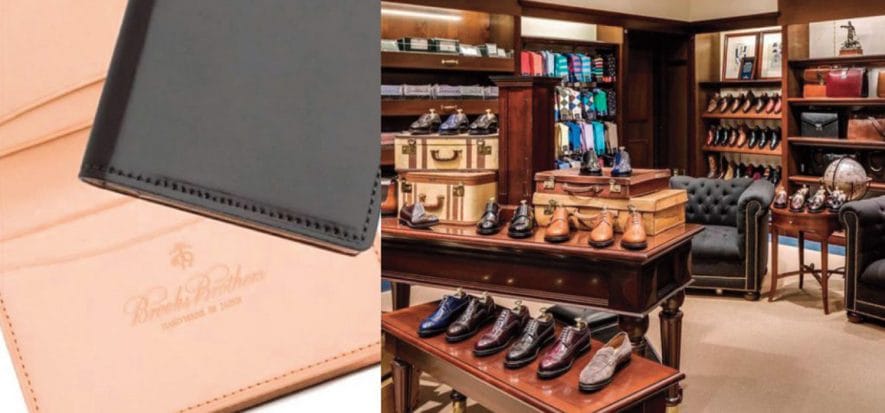

The American men’s fashion brand, which was headed by the Italian Claudio Del Vecchio, filed for bankruptcy last July, aiming at having access to Chapter 11.

At the end of the month, Sparc Group, which had already provided financial support to the brand with an 80 million dollars loan, formalised the first offer: 305 million dollars. It later raised it up to 325 million dollars. The agreement requires at least 125 Brooks Brothers stores in North America to remain open. Nothing to do then for US group WHP Global, as well as for the Italian suitors: Brooks Brothers is American again.

The recovery plan

Authentic Brands is a group owning brands such as Barneys New York, Forever 21, Nautica, Nine West, Aeropostale and Juicy Couture.

As Hypebeast points out, Chapter 11 will give new owners the ability to choose which contracts (including those with suppliers), relationships, stores and employees to keep or not. Brooks Brothers was founded by Henry Sands Brooks in Manhattan in April 1818. In 1988, it was taken over by the English Marks & Spencer, who in 2001 sold it to Retail Brand Alliance, controlled by Claudio Del Vecchio, son of Luxottica owner Leonardo.

Read also:

- First bid for Brooks Brothers: Sparc bids 305 million dollars

- Brooks Brothers (filing for Chapter 11) have two potential buyers

- Brooks Brothers are at a crossroads: to sell the three US factories or shut them