The starting date has been set for today June 14, 2021. The time of arrival, beside from any surprises, is Wednesday, July 7th. In other words, the launch of the Tender Offer focused on SICIT Group, Vicenza-based organization that turns the waste of tanneries into bio-stimulants for agriculture and products for the plaster segment.

Circularity and finance

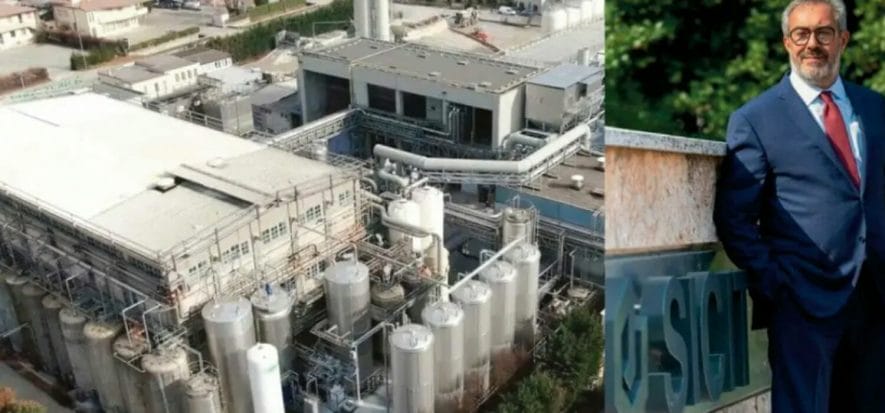

As reported by Corriere della Sera, SICIT “sets an important example of circular economy”. So, “goven the company’s characteristics, which is led by CEO Massimo Neresini (on the right in photo), it’s the first tender offer of its type to be made on Piazza Affari (Italy’s stock echange”. SICIT, in fact, “had recently had its IPO in January 2019 via the combination with Spac Sprinitaly”.

The Tender Offer’s details

“CircularBidCo will launch SICIT’s Tender offer”, the company “is the leading entity of private equity fund NB Reinassance, represented in Italy by Fabio Cané and Stefano Bontempelli, and Intesa Holding (which isn’t tied to Intesa San Paolo)”, points out Corrsera. The latter “currently holds 40.76% of the capital, which will be brought to the Tender Offer. The price, equal to 15.45 euro, takes into account a 25.8% premium compared to the average price-per-share of the last 12 months. At the end of the operation, the majority shareholder of the company will be CirculaBidCo, with NB Reinassance and Intesa Holding, which will remain the reference industrial partner for the company”. If the tender offer has good outcomes, SICIT will undergo a delisting process.

Read also:

- Syngenta Group presents an offer to acquire SICIT

- SICIT starts 2021 well: 22 million euro in revenue, +11.9%

- Circular economy: Italy, leather’s capital, is number 1 in Europe