Intesa Holding’s tanneries in Veneto join SICIT Group’s tender offer by CircularBidCo. Borsa Italiana writes that Intesa Holding “has presented the offer for 9.142.100 shares, equal to 40.67% of (Sicit’s) Capital”. This though doesn’t mean that the association made of Veneto-based tanneries will liquidate all its shares in SICIT. “Once the tender offer will be adjusted, explains Borsa Italiana –, the profits from the sale will be re-invested by Intesa Holding so as to have an equal 50% ownership of SICIT with NB Renaissance”.

Tender offer

The tender offer for SICIT began on June 14th. CircularBidCo, the core of the operation, “is the tool utilized by PE fund NB Renaissance, represented in Italy by Fabio Cané and Stefano Bontempelli, and Intesa Holding”. Now, the deal seems to be finalized. “15.45 euro per share was the price agreed upon by SICIT Group’s BoD – says Borsa Italiana -. The decision was supported by Nomura and Lazard’s analysis, both of which were asked by Sicit and the buyer to find a fair price. The entire BoD, including 4 outside members all voted in favor”. If all goes well, the tender offer will expire on July 7th.

Plan Intesa Holding’s Veneto-based tanneries

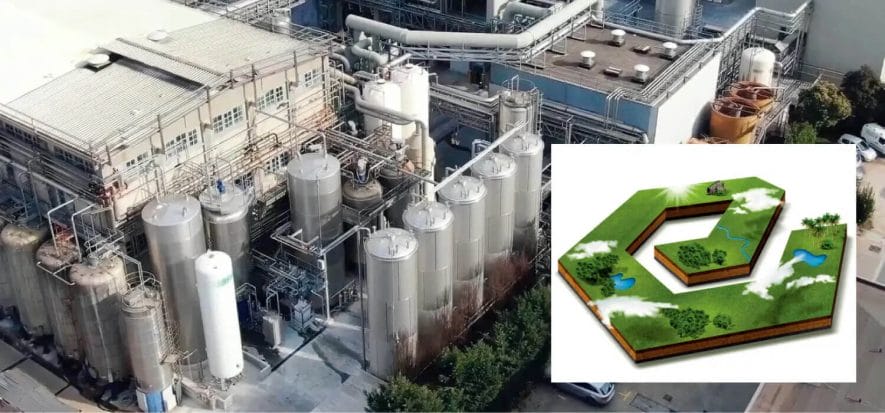

The Veneto-based tanners haven’t diluted their investment, but rather doubled down. The goal, for Intesa Holding, “is to remain the only industrial partner of SICIT”. This plan, meanwhile, “is to push growth on the global market with its financial partner, NB Renaissance – concludes Borsa Italiana -, to develop technology and create new projects, while maintaining the excellency achieved in Italy”. SICIT is a reference operator in the agrochemical and industrial sectors thanks to its process of hydrolysis of residues from the tanning industry, creates high-added-value products for agriculture (biostimulants) and plaster industry (retardants).

Read also: