The Agnelli family, through financial company Exor, invests (again) in luxury. And in leather. After spending 80 million euros to secure control of Shang Xia, a Chinese brand owned by Hermès, they invested another 541 million euros to buy 24% of Christian Louboutin. Two important operations in just three months that suggest that there may be others in the future. The Agnelli’s house moves in the luxury sector may have just begun.

541 million for the 24% of Louboutin

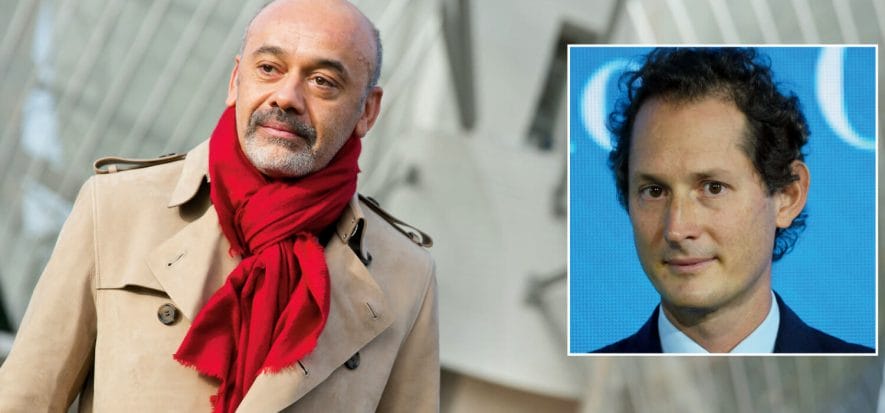

In a joint statement, Exor and Louboutin said the partnership would “accelerate the next phase of the company’s development”. The immediate goal, therefore, is to expand the brand’s presence in China, and extend its digital and e-commerce platforms. The transaction is expected to close in the second quarter of 2021. “Over the years, I have admired Christian’s talent (left, in the Shutterstock photo) in creating one of the world’s largest independent global luxury brands”, said John Elkann (right, in the Imagoeconomica photo) president and CEO of Exor, in a statement to WWD. “Christian Louboutin’s extraordinary creativity, energy and unique vision are exactly the qualities needed to build a great company”.

Louboutin says

“It was important for me – comments Louboutin to Corriere della Sera – and for the members of our company, that in order to write a new page in the history of our Maison, the partner we would associate with respected our values”. But also “he was open-minded and had an ambitious, young dynamism”. This transaction also underlines the strong interest of investors in the footwear category. There are several recent cases that go in this direction. For example, the one that saw Clarks as protagonist. Or: L Catterton buying Birkenstock, Dr. Martens IPO, Reebok listing.

Read also: