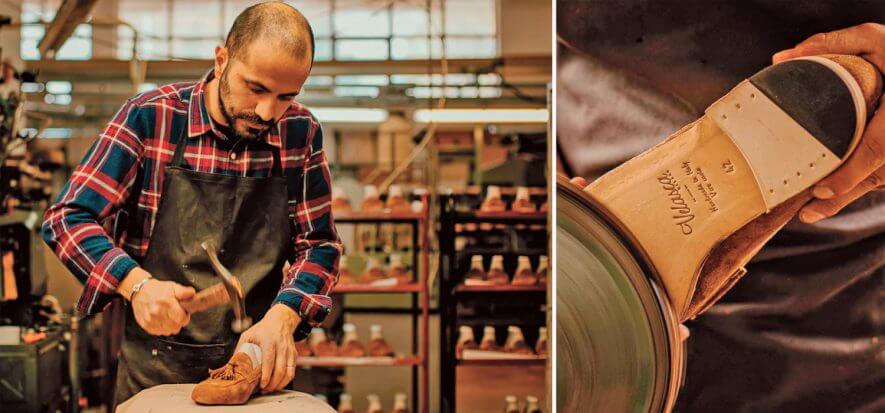

Velasca is the last brand joining the list of those that want to buy enterprises to strengthen their supply chains. For example, OTB, Moncler and Liu Jo have already said the same. Now Jacopo Sebastio and Enrico Casati, founders of the brand, are thinking of creating a Velasca Consortium and want to “open our own upper plant”. That’s because they wish to find suppliers that are up to the task, especially when it comes to footwear: “It a complex role. That’s why we would like to internalize production”. The founders also hinted to the fact that, in the future, there may be the possibility that Velasca will be opening a manufacturing site 100% owned by the brand.

Upgrading Velasca

Velasca plans on going beyond 20 million euro in revenue for 2022. It was at 12.7 in 2021. The growth though does create some complications for the brand: increasing production. The best third-party manufacturers are full of orders and, generally speaking, they struggle to find skilled workers to increase their capacity. “Finding compatible partners that are up to our standards isn’t easy”, states Jacopo Sebastio to L’Economia de Il Corriere della Sera. We would like to have our internal producers and we think of hemming services, for example, as they are fewer and fewer and getting more expensive. We would like to create a Velasca Consortium for artisans and create our own upper manufacturing site that all suppliers can access”.

Integrating the chain

Velasca is the last brand to enter the path to strengthen its production chain. During the last few weeks, OTB, Moncler and Liu Jo made statements of M&A in the footwear segment, in order to create a structure that they control directly. And then there are the investments, many fairly recent, made by large French groups and Prada. The expansion of clusters in Italy. If there is a forecast of growth, the need to guarantee quantity and, more importantly, the quality of products, is the number 1 concern now. So: acquiring specialized companies seems to be the simpler path to follow. And it may very well not be the most expensive either, given that the current context is making the lives of many SMBs very difficult.