The final balance will depend on the results we are going to achieve in the last quarter of the year, that is, Christmas shopping time. In the best possible outlook, revenues might even reach -5%. “Coronavirus second outbreak alongside limited and total lockdown all around Europe – remarked Claudia D’Arpizio, Bain & Co – make us pessimistic about it though”.

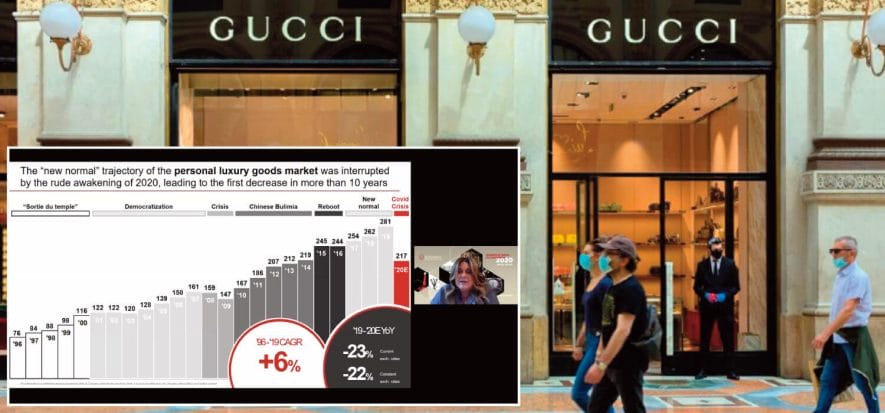

For sure, the luxury market has been suffering from a negative trend throughout 2020: looking at the final balance, revenues will supposedly reach about -22%. “This is the biggest and most unexpected downturn, in the industry, we have ever experienced – continued the financial analyst, who gave a speech at the Altagamma Monitor 2020 –. After 2009 financial crisis, the consequent downturn was less than -10%; then, immediately after, the Chinese market started booming. This time things are not going to be like that”. Nevertheless, we are not looking ahead to a fully dark scenario.

“In May, we feared results would be even worse – pointed out D’Arpizio –. Summer good performance confirmed that buyers’ trust is still alive. Fundamentals are soundly strong, and brands’ strategies are given positive feedback by clients. The market is over there, yet it needs time to enjoy recovery”.

2020 has run negative

Like we said earlier, data and figures are not that rewarding. According to the Altagamma-Bain Worldwide Luxury Market Monitor, throughout the year footwear sales dropped by 12%: sneakers had a slightly more positive trend though. Meanwhile, apparel went down by 30%, and leather goods sales decreased by 18%. Things have gone better for the luxury car industry as revenues dropped by 8 to 10%. On the other hand, talking about markets, China enjoyed a +45% boost, driven by domestic shopping return, while the rest of Asia reached -35% (-24% in Japan), the Americas -27% and Europe -36%. In the meantime, brand profitability slumped as EBITDA reached -60%.

Expectations

According to Federica Levato, Bain, “things will expectedly get back to 2019 standards at the end of 2022 or at the beginning of 2023”. For the time being, we will observe a rebound in 2021. According to Altagamma Consensus, footwear and apparel will keep going through a tough time, whereas “leather goods (+16%) will rejoice in their best performance”.

Why? Basically, for two reasons, claimed Stefania Lazzaroni (general manager of Altagamma): “Because digital channel is going to keep growing and, in addition, buyers consider bag purchase as an investment”. “For sure, growth will also be driven by tourism travel recovery – commented D’Arpizio –: not only worldwide tourism, but also interregional travelling”.

Flurries of activity

The pandemic has not only disrupted the luxury market development trend but has also modified its business attitude. The industry players are now supposed to face a specific challenge: to tackle ongoing transformation and deal with it accordingly. One factor, among others, is digital speed-up. Along with that, generation Z shopping budget is going to increase.

Brands will have to monitor the new shopping geography, which is going to be affected not only by tourism trends but also by a sort of “new discovery” of provinces and smaller towns. Attention must be mostly focused on two clashing areas, advised Bain. The former is the affordable luxury segment, where competition value is enhanced.

Top fashion houses, which place here their entry level collections, clash not only with premium higher supply, but also with emerging brands and, most of all, with second-hand market, which is currently expanding. The latter lies in the identity itself of high-end fashion brands. At this point, buyers not only look for top-notch and unique products but also demand for contents and qualities that mirror their own personality.

Read also:

- No V-shaped recovery: according to Bain the luxury industry will need 5 years

- E-commerce boom does not change one sure thing about luxury