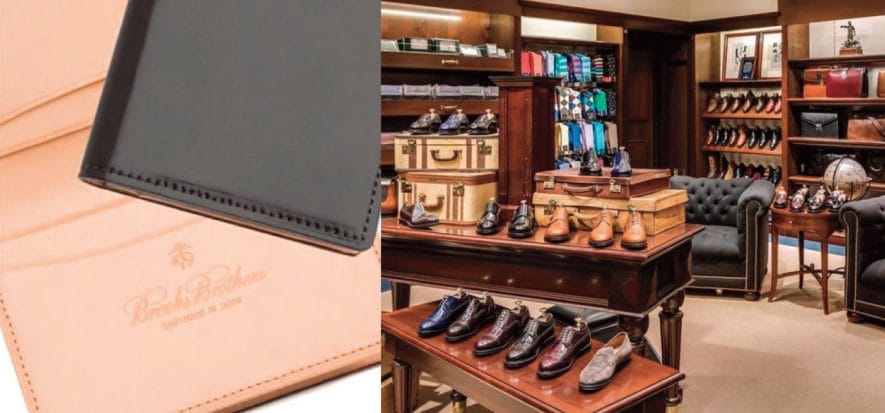

Brooks Brothers: there we go with the first bid, as a starting auction price. Sparc LLC, a company composed of Simon Property Group (the owner of a few shopping malls in the USA) and Authentic Brands Group, a fashion licence giant, launched the bid. More specifically, Sparc bid 305 million US dollars to keep in business the bankrupt brand’s stores, 125 out of about 500 in total. Besides that, the brand reportedly sold their manufacturing plant based in Haverhill, Massachusetts: the selling price was 14 million dollars.

The first bid

While issuing an official press release, Brooks Brothers announced the bid launched by Sparc, whose “aim is to actually buy out the whole of global commercial deals of the company: they bid 305 million dollars for that. Furthermore, Sparc is also going to purchase 125 selling stores at least”. Therefore, now onwards, players who want to buy out Brooks Brothers will have to launch a higher bid, which is waiting for approval: they scheduled a hearing on 3 August 2020. The deadline for possibly launching any additional bid is 5th August. Ultimately, the hearing for the final divestiture of the brand’s activity is scheduled on 11 August 2020.

An Italian group

Allegedly, an Italian group, led by Alessandro Giglio and Luciano Donatelli, could be another potential buyer of the company. In the meantime, Sparc and Brooks Brothers have signed an 80-million-dollar loan, which has successfully kept the brand in business for the time being. The same loan will enable Sparc, according to US regulations, to benefit from an advantageous start position in the event of auction sale.

Brooks Brothers’ situation

At the beginning of July 2020, Brooks Brothers filed for Chapter 11. Apparently, the strategy currently implemented by the company aims at separating production activity from retail business. In fact, as reported by WWD, the company is planning to sell their manufacturing site based in the USA (148,000 square metres, about 350 employees) to Eastern Opportunity Fund LLC: the selling price is 14 million dollars. Some documents, formerly lodged at the District of Delaware bankruptcy court, evidence that allegedly.

Read also: