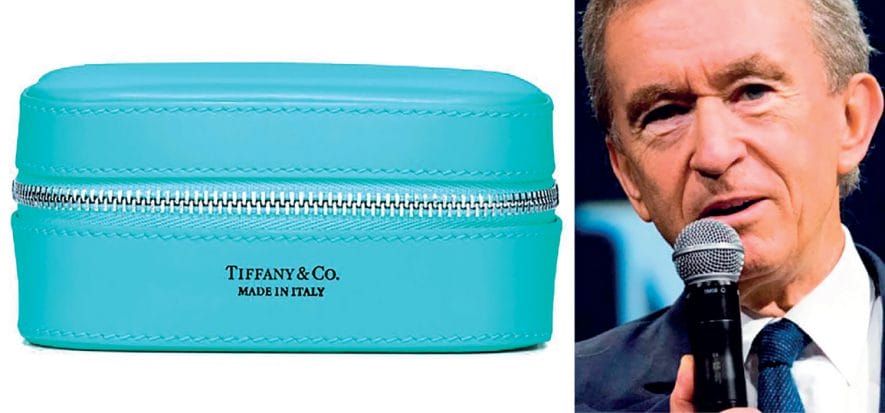

New rumours call into question the largest financial transaction in the history of luxury. In other words, there is no certainty of LVMH’ purchasing Tiffany for 16.2 billion dollars . WWD claims it. The economic repercussions caused by Covid-19 came between the agreement (November 2019) and the actual closing, initially expected in the first half of 2020. But, then, it was postponed because the virus prevented and prevents the Antitrust Commissions involved from meeting.

There is no certainty regarding the purchase

The agreement between the French of LVMH and the Americans of Tiffany is likely to turn into a soap opera. WWD yesterday re-launched the news that there is no certainty about signing the agreement. According to the magazine, an LVMH board meeting was held regarding the worsening economic situation in the US, Tiffany’s largest market, following not only CRV, but also the ongoing violent protests. Thus, concerns would have emerged about Tiffany’s possible difficulty in meeting its debt obligations included in the agreement. According to WWD, the message launched by the managers is clear: reconsider the evaluation of the purchase. Neither side offered any comment. Tiffany’s shares immediately went from nearly 128 to 116 dollars. The deal is priced at 135 dollars per share.

It is not the first time

It is not the first time that the agreement has been called into question. For example, last March, Bloomberg wrote that LVMH was reflecting on the convenience of buying the shares on the market, as their listing was cheaper than the 135 dollars they agreed on. But LVMH clearly denied it. In mid-April, however, the Australian antitrust authority requested, and obtained, an extension from April 8 to October 6 to evaluate the acquisition. The reason: the virus prevents meetings.

Read also:

- Among the effects of CRV, LVMH-Tiffany closing postponed

- LVMH denies: it won’t be buying Tiffany’s stocks on the market

- Tiffany stable in 2019, will LVMH renegotiate the acquisition’s terms?