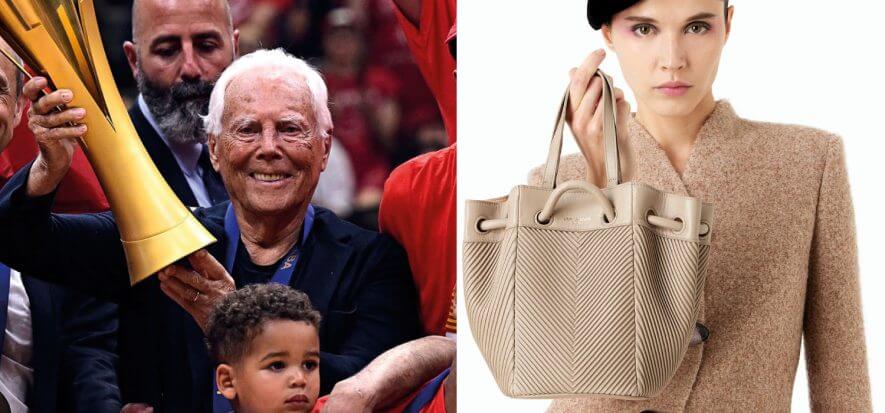

Today, Armani group is worth between EUR 7 and 10 billion. While an IPO on the Milan Stock Exchange would have a capitalisation of between EUR 5 and 7 billion. Some analysts claim this in light of the new statute through which the king of Italian fashion has outlined the future of his group. Including succession. After five years from the entry into force of this document, the heirs could think about an IPO. According to analysts, Armani today would retrace the success of Moncler on the stock exchange.

Between EUR 5 and 7 billion

“The analyst of a major global investment bank believes that if it were to list today, the capitalisation of the Giorgio Armani group could be between EUR 5 and 7 billion”. This is written by Mf Fashion, which does not reveal the names of the analysts contacted. Another explains that, to make the same calculation in relation to companies comparable with Armani, one multiplies the net profit by 25. Thus, King Giorgio having declared EUR 162 million profit in the last financial year, today’s valuation would oscillate “between EUR 4 and 5 billion, from which any debt would have to be subtracted”.

On one condition

The condition for this to remain valid over time, however, is above all one, say the analysts. In other words, Armani, understood in the totality of its offer, must be perceived by the market as a brand positioned in “true luxury” and not perceived as “accessible luxury”. If this were to happen, its value could be halved. By meeting this condition, however, it would have the potential to replicate the success of Moncler “which is now quoted at 22 times its EBITDA”.

Sales value

But if Giorgio Armani were for sale today, what would its value be? According to experts, the market price would range from EUR 7 to 10 billion. The company has a high value because, the analysts go on to explain, it is a unique luxury company ranging from ready-to-wear to haute couture, from hospitality projects to home furnishings, fragrances and eyewear.

Read also: