The luxury segment is in good health and has a bright future thanks to Asia. Italy is ‘the’ country for fashion, but its main businesses are small and find it difficult to grow. Same goes for footwear and handbags, and this assessment is proved by the fact that these segments have inferior growth in comparison to other sectors. These are just some of the verdicts of the 6th edition of Global powers of luxury goods, Deloitte’s annual study presented in London. “The luxury goods’ market continues to grow after a 3-year run, even while faced by the challenges posed by the global economy’s slowdown. The forecast says that the demand for luxury goods will continue to be positive in the future”, stated Patrizia Arienti, Deloitte Emea fashion & luxury leader. Supporting the positive performance of luxury goods are those mid-range consumers that have increased their income, but that can’t yet be classified as wealthy. They are the so-called “HENRY”, “High Earners Not Rich Yet” that are mostly Asian.

Top 10

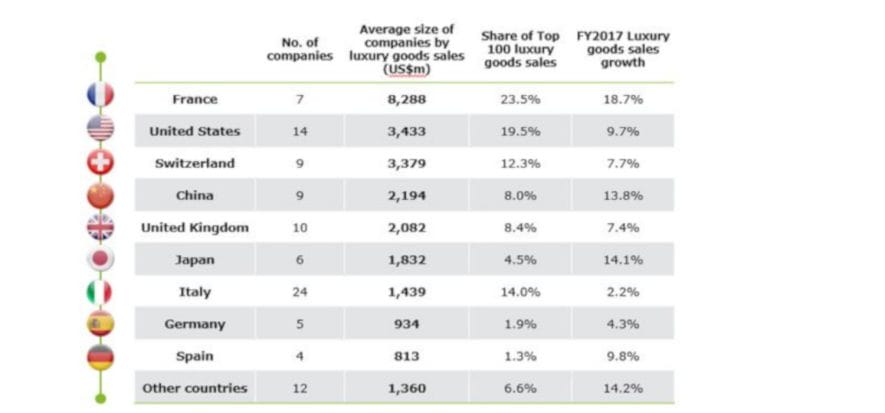

The 100 largest luxury companies in the world published revenue data for 247 billion USD during the 2017 fiscal year (which includes the ones that closed on June 30th, 2018), with a 10.8% increase at constant exchange rates, in comparison to the +1% of the previous period. If the revenue of the 10 largest companies is added together, it is noticeable that the number accounts for nearly half of the total (48.2%) with a +1% over the previous period. The first 6 groups are: LVMH, The Estèe Lauder, Richemont, Kering, Luxottica and Chanel (for the first time in the ranking). Moreover, with regards to segments, cosmetics is the one with the strongest performance (+16.1%), then watches and jewelry (+9.7%), clothing and footwear (+3.2%) and handbags and accessories (+1.5%).

Italy’s role

The number of Italian companies present within the top 100 list are 24 (2/3 of them make clothing and footwear), generate 14% of total global revenue, but only have a 2.2% growth in comparison to the previous report. The have small-business syndrome, in comparison to French giants that, on the other hand, increased their sales numbers by 18.7%. The best ones are: Luxottica (5th place), Prada (21st place), and Giorgio Armani (26th place), with Moncler as the most performing one (+20.9% net profit margin), while Furla recorded a higher sales rate (+18.7%). The first three players, meaning Luxottica, Prada and Giorgio Armani, accounted for almost half of the sales generated within the Italian luxury industry. Giuseppe Zanotti became a new entry in 96th place.

“Italian businesses defend their leadership, but in order to win the contest they will need to join innovative business models with the tradition and exclusivity of the product”, explains Arienti.