Neither real estate, nor gold: at Collector Square, bag is a safe-haven asset. It works even better than Government bonds. Nicolas Orlowski, founder of the luxury second-hand sales platform, is sure about that. “Several research projects tell us that such investment is more profitable than a real estate – he points out –. Many bags enhance their own value when they turn second-hand items”. Which ones? “Limited edition bags by Chanel – he tells Le Figaro – or others created by using exotic leather, especially when fashion houses give up production. Buyers may find such commodities exclusively in the second-hand market”.

At Collector Square bag is a safe-haven asset

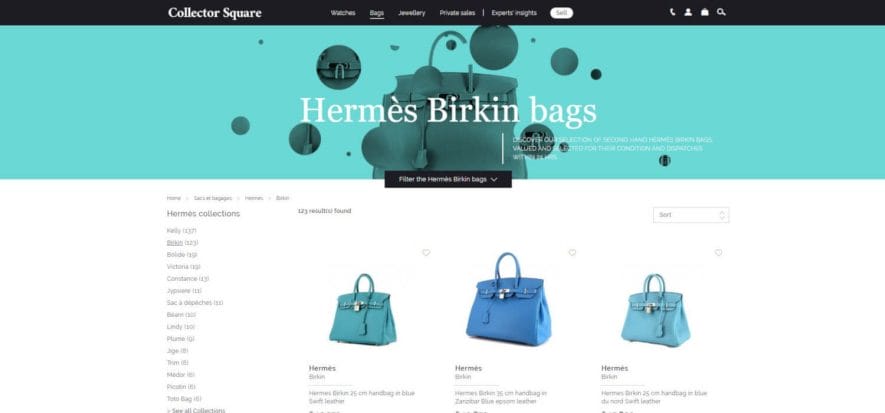

Launched in 2013, Collector Square developed over time thanks to valuable expertise acquired by Orlowski during his previous project. In fact, the founder is also the man who created Artcurial, a French auction house which has become the third most important one in Paris, after Christie’s and Sotheby’s, in less than 20 years since its opening. “Collector Square’s daily work revolves around demand for bags online (about a hundred a day), in our showroom and in our pop-up store – emphasizes Orlowski –. We select the most appealing products, in the best conditions, and we sell them at the best price”.

The selection stage

A team of experts oversee the selection stage: they analyse each single product. After examining its state of repair and considering market demand, the team fix a selling price. Then they write a report over each bag model, made by fashion brands, which is bound to be a useful benchmark both for sellers and for buyers.

Prices

Customers find a section, in Collector Square portal, where, starting from the fashion brand, they can pick a bag model and subsequently monitor its selling price trend. In doing so, they can see the way prices float, up and down, through the LuxPrice-Index, with regard to over 32,000 branded products, made by, among others, Louis Vuitton, Chanel, Gucci, Dior, Celine, and also Bottega Veneta, Balenciaga, Mulberry, Christian Louboutin and Tod’s.

The most searched

“Personally, I would recommend an iconic article, created by a great fashion house, whose value and appeal go beyond time: Kelly or Birkin by Hermès, Timeless or 2.55 Chanel, or Speedy, or Keepall by Louis Vuitton – comments Orlowski –. Then we may move on to quite rare items, which are no longer in production, such as the Constance model, by Hermès, or a few capsule collections by Louis Vuitton”. They are almost unique pieces that require a considerable investment. Yet, according to experts, they will prove to be an extremely profitable investment in the future. Meanwhile, focus on collectors in the next future. “By the end of the year, we shall launch a department dedicated to collector’s items – announces the entrepreneur –. Overall, demand for rare, exotic and limited editions is still driving our leather goods department”.

Picture taken from Collector Square

Read also: