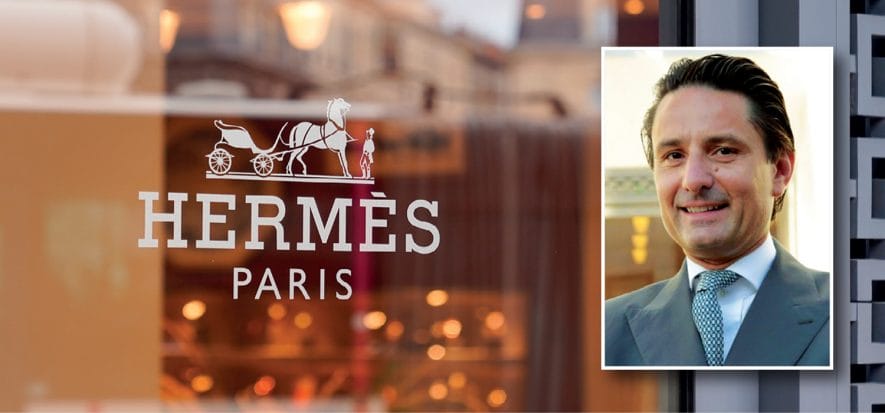

In 2020 first quarter, Hermès sales decreased to a limited extent in the end. On the other hand, the French brand well knows that the worse is yet to come. Nonetheless, from January to March, unlike many “competitors”, Hermès did not lose much ground “thanks to artisan model solidity”, pointed out executive president Axel Dumas (in the picture box). The fashion house confirmed the whole of their production investments, though they have not provided any forecast for 2020: despite that, they say they are high on the possibility to enjoy again a mid-term boost.

Better than expected

At the end of 2020 first quarter, Hermès revenues amounted to 1.5 billion euros, therefore dropping by 6.5% at current rates of exchange and by 7.7% at fixed rates of exchange. In terms of value, they exceeded 1.45 billion euros, formerly estimated by FactSet consensus. Earnings coming from the Leather Goods and Saddlery unit went down by 6%. In the meantime, the French group have confirmed the implementation of their investments to enhance manufacturing capacity.

Artisan model solidity

“We rely on our artisan model solidity – commented Axel Dumas – alongside the appeal of our accessories and endeavours carried out by all of Hermès teams, which are a set of paramount assets”. Besides that, most of all, such tools “will help us overcome, in a confident manner, instability we have been going through in the first months of the year”. Along with data and figures, Hermès made public that, for the time being, “only stores in China and Korea are open, while sales in Japan are running at a very limited speed”. That is the gist of the story: “The situation will remarkably affect sales throughout the second quarter of the year”.

No forecast

At present, claim the fashion house, it is “hard to estimate” the real impact of the pandemic caused by Covid-19 outbreak. Yet, they are confident about a mid-term recovery: “Despite growing instability, which is going to affect economic, geopolitical and financial areas, all over the world, Hermès have stated again their ambitious aim to augment revenues at fixed rates of exchange”.

Smaller shares of profit

The company decided to reduce shares of profits for shareholders, who will take 4.55 euros, rather than 5.00, per single stock. In other words, they will gain as much as they did in 2019. In addition, top managers also decided to give up their fixed pay rise, throughout 2020, and the whole offloating wagesthey were supposed to take in 2020, according to the previous year.

Read also: